SEBI reforms 2025 aren’t just “regulatory updates.” They’re operational triggers—changes that affect how units are handled in SIFs, when algo-trading compliance kicks in, and how NRIs are monitored in derivatives.

If you’re an AMC, broker, algo provider, or ops/compliance lead, these reforms can impact investor experience (freezes, notices, redemptions), system workflows (timelines and monitoring), and process hygiene (what you must collect, track, and prove).

Here’s what changed, why it matters, and what you should do next.

What SEBI Reforms 2025 Covered (Quick Snapshot)

SEBI’s latest package includes three updates:

- A clear enforcement flow for the SIF minimum investment threshold (₹10 lakh)

- A revised timeline for the SEBI algo trading rules 2025

- A simpler process under the NRI derivatives rules of SEBI, without weakening oversight

1) SIF Minimum Investment Threshold: Freeze → 30-Day Notice → Auto Redemption

What changed

SEBI introduced a tighter monitoring mechanism for the SIF minimum investment threshold. Investors are expected to maintain ₹10 lakh across SIF strategies. A drop below this level is treated as an active breach.

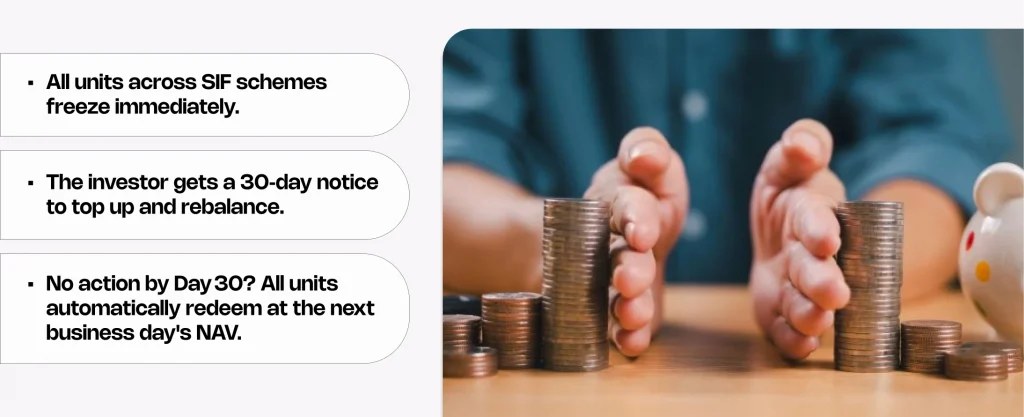

What happens during an “active breach”

If an investor’s aggregate holdings across SIF strategies fall below ₹10 lakh:

- All units across SIF schemes freeze immediately

- The investor receives a 30-day notice to top up and rebalance

- No action by Day 30? Units are automatically redeemed on the next business day’s NAV

Why it matters

This is a shift from vague enforcement to predictable execution:

- Investors get clarity: A freeze is structured and reversible within a defined window.

- AMCs get consistency: The mechanism reduces ad-hoc handling and confusion.

- Operations become auditable: Clear timelines make oversight and reporting cleaner.

Bottom line: This change is less about punishment and more about control, transparency, and repeatable process.

2) SEBI Algo Trading Rules 2025: Implementation Delayed (Use the Time Wisely)

What the earlier plan looked like

SEBI’s earlier framework for algorithmic trading covered:

- API controls and permissions

- broker and exchange responsibilities

- onboarding of algorithm providers

- classification approaches (for example, white-box vs black-box)

These changes were expected to go live quickly—creating concern around readiness.

What changed now

SEBI deferred implementation to October 1, giving the ecosystem time to prepare.

Why this delay matters

This is not extra time to relax—it’s extra time to avoid expensive failures.

Use the runway for:

- system testing (permissions, access, audit logs)

- classification readiness (what’s allowed, restricted, and must be disclosed)

- process hardening (SOPs, escalation paths, incident response)

- Team training (support and relationship teams need simple answers)

Bottom line: SEBI reforms 2025 are pushing the market toward controlled automation with accountability.

3) NRI Derivatives Rules SEBI: Less Paperwork, Same Monitoring

What was painful earlier

NRIs trading exchange-traded derivatives had additional procedural steps—especially around clearing/custody mapping and CP code-related notifications—to enable monitoring for position limits.

What changed

SEBI simplified the process by removing the need to submit CP code details as an extra step. Exchanges and clearing corporations will monitor NRI position limits at the client level, similar to resident clients.

Why it matters

This reduces friction without reducing oversight:

- fewer avoidable errors

- cleaner onboarding and support workflows

- a smoother experience for NRIs who don’t know India’s operational nuances

Bottom line: It improves execution while keeping controls intact.

Why SEBI Reforms 2025 Matter More Than the Headlines

These reforms point to one direction: compliance is becoming workflow-first.

- SIF enforcement becomes structured and automatic

- algo compliance moves toward testable, operational adoption

- NRI oversight stays intact while unnecessary steps are removed

This is how regulation scales—not by adding paperwork, but by refining systems.

What To Do Next (Operational Checklists)

For AMCs and Funds

Operational priority: threshold detection + notice automation + redemption workflow

Checklist:

- Monitor investor holdings to detect an SIF minimum investment threshold breach early

- Implement a workflow: freeze → notice → expiry → redemption

- Automate notice delivery and proof of delivery (audit-ready)

- Align investor support scripts on what a freeze means and how to restore holdings

For Brokerage Firms and Algo Providers

Operational priority: controls + testing + training before Oct 1

Checklist:

- Test API permissions, access controls, and logging end-to-end

- Review the algorithm provider onboarding and classification workflows

- Train teams on “what changes on Oct 1” using clear, simple explanations

- Update SOPs and escalation pathways for incidents and exceptions

For NRI Investors and Service Providers

Operational priority: remove outdated steps and reduce process risk

Checklist:

- Remove CP code collection/submission steps where no longer needed

- Update internal manuals and client onboarding instructions

- Keep monitoring and audit trails clean—simpler process doesn’t mean weaker oversight

Where BeFiSc Fits: Strong Compliance Needs Strong Execution

SEBI reforms 2025 increase pressure on teams to be consistent, auditable, and fast—compliance can’t be “on paper” anymore.

That’s where BeFiSc fits in the ecosystem.

BeFiSc helps teams reduce operational risk through verification and fraud-signal infrastructure that supports:

- cleaner onboarding and identity verification

- stronger fraud signals before decisions

- audit-friendly workflows designed for scale

If you’re already tightening processes for SEBI-aligned execution, this is also the right time to strengthen the foundations that quietly drive compliance risk: identity, fraud signals, and verification discipline.

Book a demo to see how BeFiSc fits into your compliance and risk workflows.

FAQs

What are SEBI reforms 2025 and who do they impact?

SEBI reforms 2025 introduce three practical changes. First, SEBI tightened monitoring for the SIF minimum investment threshold. Second, it extended the timeline for algo trading compliance. Third, it simplified NRI derivatives procedures. As a result, AMCs, brokers, algo providers, NRIs, and their service partners must update workflows and client communication.

What is the SIF minimum investment threshold under SEBI reforms 2025?

Under SEBI reforms 2025, investors must maintain a ₹10 lakh aggregate holding across SIF strategies. If holdings drop below ₹10 lakh, the AMC can freeze units, send a 30-day notice, and then redeem units after the deadline. In short, SEBI has made enforcement clearer and more predictable.

Why did SEBI delay the SEBI algo trading rules 2025?

SEBI delayed the SEBI algo trading rules 2025 to help market participants implement controls smoothly. For example, brokers and exchanges can now test APIs, strengthen audit logs, and train teams before the deadline. Therefore, firms can reduce disruption while still meeting compliance expectations.

What changed under NRI derivatives rules SEBI?

Under NRI derivatives rules SEBI, NRIs no longer need to complete certain CP code-related procedural submissions. Instead, exchanges and clearing corporations track position limits at the client level, just like they do for resident clients. Additionally, this change reduces paperwork while keeping oversight intact.