RBI pension rules for 2024–25 have been tightened through the latest Master Circular on government pension disbursement by agency banks, consolidating all instructions up to March 31, 2025. These RBI pension rules directly affect how banks credit monthly pensions, apply Dearness Relief (DR), handle life certificates, and compensate pensioners for delays.

For agency banks, these RBI pension rules are no longer just procedural guidance. Instead, they create enforceable obligations around timelines, transparency, and accountability—especially when pensioners face service failures.

If your pension gets delayed, the RBI pension rules now ensure the bank—not the retiree—bears the cost.

Why This Matters Now

A government pension is often a retiree’s primary monthly income. Still, many pensioners face avoidable issues like delayed credits, missed DR updates, missing life certificates, and slow complaint handling.

As a result, RBI has strengthened the framework to ensure dignity, speed, and accountability in pension servicing across Central and State pensioners.

What Is the RBI Master Circular on Pension Disbursement?

The RBI’s Master Circular titled “Disbursement of Government Pension by Agency Banks” is the rulebook for banks appointed by the government (agency banks). It governs:

- Monthly pension credits

- Dearness Relief (DR) implementation

- Grievance redressal

- Timely refunds and corrections

- Support for sick and incapacitated pensioners

- Life certificate acknowledgements and CBS updates

In short, it standardises pension handling and reduces branch-level confusion.

The 7 Critical Failures RBI Wants Banks to Stop

1) Delaying Monthly Pension Credits

Banks must credit pensions on time as per Pension Paying Authority instructions. Even a small delay can disrupt medical and household expenses. Therefore, RBI expects pension credit to be treated as a priority banking obligation.

2) Holding DR Payments Until “Paperwork Arrives”

Earlier, some banks waited for physical government orders before applying DR hikes. Now RBI instructs banks to accept DR orders via email, fax, post, or official websites and act immediately.

In other words, DR updates should move at notification speed—not file speed.

3) Waiting for RBI Confirmation Before Acting

RBI has clarified that banks must implement all government pension circulars (Central/State) without waiting for separate RBI approvals.

So, delays caused by “we’re waiting for RBI” are no longer acceptable.

4) Mishandling Excess Pension Refunds

When excess pension is paid, RBI splits the responsibility clearly:

- If it’s the bank’s error, the bank must refund the full amount to the government immediately, even if recovery from the pensioner is pending.

- If it’s the government’s error, the bank must coordinate directly with the concerned department in a time-bound way.

This prevents pensioners from being stuck between departments.

5) Making Sick or Incapacitated Pensioners Struggle

RBI’s guidance is human-first. Banks must allow pension withdrawals even if pensioners cannot sign, by permitting:

- Thumb/toe impression verified by two witnesses (one bank official)

- A mark on the withdrawal slip (if impression isn’t possible)

- A nominated person to withdraw on the pensioner’s behalf with proper identification

Additionally, branches should display these instructions prominently and train staff to handle such cases sensitively.

6) Treating Life Certificates Like a “Maybe”

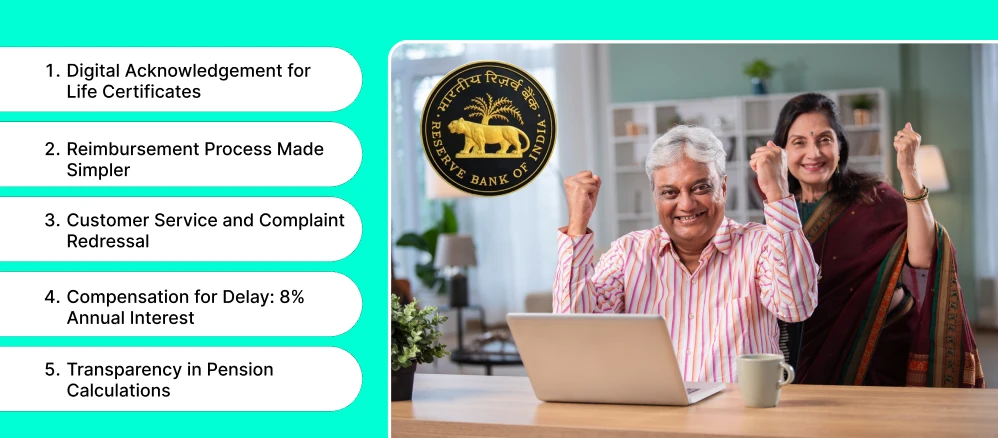

Pensioners should not face stoppage because a life certificate was misplaced or not logged. Therefore, banks must:

- Provide a signed acknowledgement for physical life certificates

- Update records in CBS promptly

- Enable digital acknowledgement for Jeevan Pramaan submissions

This improves traceability and prevents wrongful stoppages.

7) Ignoring Complaints Until Escalations Start

RBI pushes banks to take pensioner grievances seriously. It recommends:

- Dedicated toll-free pension helplines with trained staff

- Nodal officers at the regional levels

- Quarterly meetings with pensioners

- Pension Adalat-style grievance forums

- Monthly review of complaints by the GM/CGM in each region

As a result, complaint handling becomes measurable and reviewable.

The Most Important Rule: Compensation for Delay (8% Annual Interest)

This is the strongest provision in the circular.

If pension credit is delayed, the bank must:

- Pay 8% annual interest on the delayed amount

- Credit the interest automatically

- Maintain records for RBI inspections

So pensioners don’t have to chase the bank for compensation.

Transparency in Pension Calculations

RBI wants pensioners to understand their payouts. So banks should:

- Provide pension calculation details online and at branches

- Explain how DR hikes and revisions change monthly amounts

- Guide pensioners clearly in case of confusion

This reduces disputes and builds trust.

Internal Audits and Inspections: Pension Service Is Now Audit-Critical

Agency banks must include pension service delivery in internal audits. RBI expects:

- Checklists for timeliness, DR implementation, acknowledgements, and records

- Random calls to pensioners for direct feedback

- Complaint status tracking as part of inspection reports

Therefore, pension servicing becomes a compliance and audit topic—not just customer service.

What This Means for Pensioners

This circular improves pension security by ensuring:

- Timely pension and DR credits

- Easier access for elderly and incapacitated pensioners

- Stronger grievance systems

- Automatic interest for delays

- Better clarity on entitlements

What This Means for Banks

Agency banks must now treat pension disbursement as:

- Time-bound

- Trackable

- Auditable

- Financially accountable

If systems are weak, the bank will pay through interest, complaints, and audit observations.

Where BeFiSc Fits In

When servicing standards tighten, operational gaps become compliance gaps. BeFiSc helps banks and fintech partners strengthen workflow readiness by enabling:

- Better audit trails and operational traceability

- Stronger identity and verification checks were needed

- Cleaner monitoring signals that reduce service failure risks

- Compliance-aligned process design without slowing operations

Conclusion

The RBI Master Circular 2024–25 is a clear blueprint for pension disbursement that is faster, fairer, and more accountable.

For pensioners, it protects rights and improves service.

For banks, it raises the bar—and adds real financial consequences for delays.

.

What are the RBI pension disbursement rules?

They are RBI’s consolidated instructions for agency banks on timely pension credit, DR updates, grievance handling, life certificates, and service standards.

What happens if a bank credits a pension late?

The bank must pay 8% annual interest on the delayed amount and credit it automatically.

Can a sick or incapacitated pensioner withdraw their pension without a signature?

Yes. RBI allows thumb/toe impression or even a mark, verified by witnesses, including a bank official. A nominated person may also withdraw on their own behalf.

Will banks acknowledge life certificate submission?

Yes. Banks must provide acknowledgements for physical submissions and enable digital acknowledgements for Jeevan Pramaan submissions.