Gold Loan Guidelines have always played a quiet but critical role in India’s credit ecosystem. Because gold loans are collateral-backed and quick to disburse, households, MSMEs, and small borrowers rely on them during periods of cash-flow stress.

Over time, however, the rapid expansion of gold lending—especially through NBFCs and fintech platforms—began to expose structural gaps. Valuation practices varied widely across lenders. At the same time, bullet repayment loans allowed risk to build invisibly. In many cases, borrower protection depended more on internal processes than on regulatory safeguards.

In June 2025, the Reserve Bank of India responded with updated rbi guidelines for gold loans, introducing a single, uniform framework for banks, NBFCs, cooperative banks, and housing finance companies.

Rather than slowing credit growth, these changes aim to make gold lending more transparent, disciplined, and borrower-centric.

Why the RBI Guidelines for Gold Loans Were Needed

For several years, gold lending followed a largely rule-based approach. Most lenders focused heavily on collateral value, while repayment capacity and rollover risks received limited attention.

Meanwhile, digital lending systems made renewals and top-ups easier to execute but harder to monitor in real time. As a result, the regulator began observing stretched LTV ratios, weak tracking of bullet repayment loans, and recurring delays in returning pledged gold after loan closure.

Because of these patterns, the rbi guidelines for gold loans reflect a broader shift toward principles-based regulation. Under this approach, governance, risk management, and borrower protection carry more weight than checklist-driven compliance.

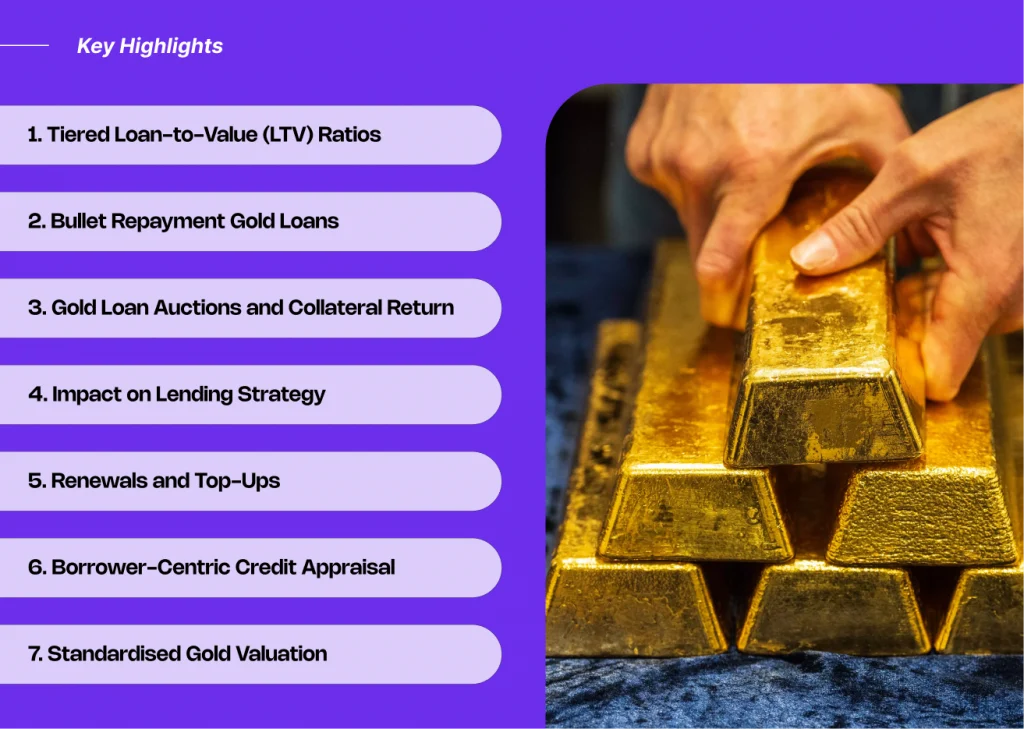

Key Highlights of the RBI Gold Loan Rules (2025)

The updated rbi gold loan rules introduce structural changes across the entire gold loan lifecycle, from disbursement to closure.

1. Tiered Loan-to-Value (LTV) Ratios

Under the revised rbi rules on gold loans, LTV limits now depend on the size of the loan:

- Loans up to ₹2.5 lakh → LTV up to 85%

- Loans between ₹2.5–₹5 lakh → LTV capped at 80%

- Loans above ₹5 lakh → LTV capped at 75%

In effect, smaller borrowers gain easier access to credit. At the same time, larger loans remain tightly controlled to prevent excessive risk concentration.

2. Bullet Repayment Gold Loans

Earlier, lenders calculated LTV only at the time of disbursement. Over the loan tenure, however, accumulated interest quietly pushed risk higher.

To address this gap, the rbi gold loan rules now require lenders to calculate LTV on the total repayment amount at maturity. Additionally, bullet loans must close within 12 months.

As a result, risk can no longer remain hidden behind end-date checks.

3. Gold Loan Auctions and Collateral Return

Borrower protection sits at the core of the rbi rules on gold loans.

Under the new framework:

- Borrowers must be present during the gold valuation

- Lenders must return auction surplus within 7 working days

- Pledged gold must be released within 7 working days of loan closure

- Delays attract a ₹5,000 per day penalty

Together, these timelines improve transparency and significantly reduce borrower uncertainty after repayment.

Borrower-Centric Credit Appraisal Under RBI Rules

Traditionally, gold loans relied almost entirely on collateral value. Now, however, the rbi guidelines for gold loan companies require lenders to look beyond gold weight and purity.

Specifically, lenders must:

- Assess borrower repayment capacity

- Conduct due diligence beyond collateral

- Avoid over-leveraging borrowers

Consequently, the gold loan rbi framework aligns gold lending more closely with responsible credit practices followed across retail lending.

Renewals and Top-Ups: Clear RBI Guidelines

The rbi guidelines for gold loan companies also tighten controls around renewals and top-ups.

Under the revised structure:

- Renewals are allowed only if sufficient LTV headroom exists

- Borrowers must clear accrued interest before renewal

- Lenders must perform a fresh credit appraisal

- Systems must clearly tag renewals and top-ups

Because of these changes, lenders can no longer evergreen stressed loans without visibility.

What This Means for NBFCs, Fintechs, and Lenders

Taken together, the revised rbi gold loan rules reshape lending strategies at multiple levels.

For lenders, compliance and monitoring requirements will increase in the short term. Over time, however, stronger asset quality and regulatory confidence should follow.

For borrowers, the framework brings fairer valuation, faster collateral release, and clearer communication throughout the loan lifecycle.

For fintech platforms, lending engines must support tiered LTV logic. In addition, borrower consent and valuation acknowledgment become essential. Ultimately, compliance must be built into workflows from day one.

Where BeFiSc Fits In

As the rbi guidelines for gold loans tighten controls around valuation, renewals, and borrower checks, lenders increasingly need stronger verification and monitoring layers.

This is where BeFiSc fits naturally.

BeFiSc helps lenders:

- Verify borrower identity and documents

- Detect inconsistencies or manipulation in submitted data

- Strengthen pre-disbursal and renewal checks

- Maintain audit-ready compliance across lending workflows

In today’s gold loan rbi environment, trust is no longer assumed. Instead, it must be verified.

Final Takeaway

The 2025 reforms send a clear message:

Gold lending must grow with discipline, not shortcuts.

By tightening LTV norms, regulating bullet loans, standardising valuation, and strengthening borrower protection, the rbi guidelines for gold loans create a safer and more transparent ecosystem.

For lenders and fintechs alike, this shift is not a constraint. Rather, it is an opportunity to build trust-led, regulation-ready gold loan products.

FAQs: RBI Guidelines for Gold Loans

1. What are the RBI guidelines for gold loans?

They define LTV limits, valuation norms, bullet repayment rules, renewal conditions, and borrower protection timelines.

2. Do RBI gold loan rules apply to NBFCs and fintechs?

Yes. The RBI gold loan rules apply uniformly to banks, NBFCs, cooperative banks, and gold loan fintech platforms.

3. What is the maximum LTV allowed under RBI rules on gold loans?

Up to 85% for loans up to ₹2.5 lakh, with lower caps for higher loan amounts.

4. Why did the RBI issue guidelines for gold loan companies?

The RBI introduced these guidelines to improve risk management, valuation consistency, borrower protection, and long-term system stability.