The Reserve Bank of India (RBI) has proposed a simplified claim settlement process for deceased bank account holders who did not nominate anyone or whose joint accounts lack a survivorship clause.

Under the draft guidelines, banks must allow claim settlement up to ₹15 lakh through a straightforward document-based process – without requiring a court order or third-party indemnity bonds. The circular aims to reduce distress for legal heirs and standardize procedures across banks. The final version is expected to take effect by January 1, 2026, after public consultation.

When a bank account holder passes away without naming a nominee, family members often face a frustrating maze of paperwork, legal complexities, and delays before accessing their loved one’s funds. These delays not only cause emotional stress but can also create serious financial hardship for dependents.

Over the years, the RBI has received numerous complaints about inconsistent practices among banks in settling such claims. Some demanded succession certificates; others insisted on court orders or sureties – even for small amounts.

To solve this, RBI’s draft circular titled “Reserve Bank of India (Settlement of Claims in respect of Deceased Customers of Banks) Directions, 2025” aims to standardize and simplify how banks handle deceased customer accounts, especially in cases where no nominee or survivorship clause exists.

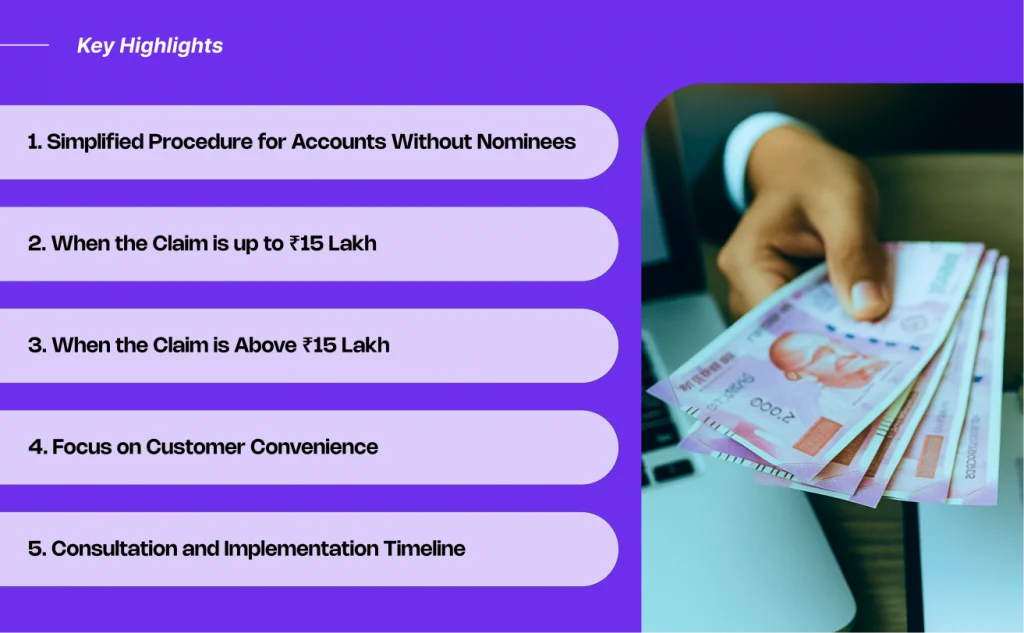

Key Highlights of the Draft Circular

1. Simplified Procedure for Accounts Without Nominees

Banks will now have to follow a simplified claim settlement process for deceased depositors who did not appoint a nominee or for joint accounts lacking a survivorship clause.

Threshold:

- Each bank must set a threshold for simplified settlement, minimum ₹15 lakh.

- Banks can choose to go higher based on their internal risk systems.

The goal is to ensure that families aren’t subjected to unnecessary hurdles or legal wrangling for modest amounts.

2. When the Claim is up to ₹15 Lakh

If the total claim value is ₹15 lakh or less, and there’s:

- No Will left by the deceased,

- No contesting claim, and

- No court order restraining payment -then, banks must release funds based on the following documents:

Required Documents:

- Duly filled claim form signed by claimants.

- Death certificate of the account holder.

- Officially Valid Document (OVD) for claimant’s identity and address.

- Bond of Indemnity/Surety signed by claimants (as per Annex I-C).

- Letter of Disclaimer/No Objection from non-claimant legal heirs (if any).

- Legal Heir Certificate issued by a competent authority, or a declaration by an independent person known to the family and acceptable to the bank.

Importantly, no third-party surety or external indemnity bond will be required for such claims.

This is a major relief – previously, claimants often struggled to find third-party guarantors, leading to long delays.

3. When the Claim is Above ₹15 Lakh

For claims above ₹15 lakh, the process is slightly stricter to ensure authenticity.

In addition to the above documents, banks will need:

- Succession certificate; or

- Legal Heir Certificate / Affidavit (sworn before a judge or magistrate) from an independent person known to the family and acceptable to the bank.

- A third-party indemnity bond may also be sought, depending on the bank’s risk assessment.

4. Focus on Customer Convenience

The circular emphasizes that the process should be customer-friendly – avoiding unnecessary hardship, repeated document requests, or procedural rigidity.

This language signals a shift in RBI’s approach: prioritizing accessibility and empathy over bureaucracy.

5. Consultation and Implementation Timeline

- Public feedback open till: August 27, 2025.

- Likely effective date: January 1, 2026 (or earlier, based on RBI’s final approval).

This gives banks a few months to update their internal policies and systems to align with the new directions.

Why This Matters

Historically, when an account holder dies without a nominee, banks freeze the funds until all legal formalities are completed. The family’s ordeal often includes:

- Multiple visits to the branch,

- Getting court-issued succession certificates,

- Obtaining signatures and affidavits from all legal heirs,

- Providing indemnities and third-party sureties.

This could drag on for months – even for small savings accounts.

By setting a clear and simplified ₹15 lakh limit, RBI aims to cut through red tape, reduce distress, and ensure that rightful claimants receive funds quickly and transparently.

Impact on Fintechs and Banks

1. What Banks Should Do

Banks will need to:

- Revise internal policies on deceased claim settlements.

- Digitize the claim submission process (preferably via online portals).

- Train branch staff to handle such cases empathetically and efficiently.

- Establish a risk-based approval mechanism for verifying claim authenticity.

They’ll also have to ensure consistency across branches – no more arbitrary requirements differing from one branch to another.

2. For Fintechs and Neobanks

Many fintech platforms offer banking-as-a-service or digital accounts via partner banks. This circular will directly impact how those fintechs:

- Manage account closures after customer death,

- Handle nominee/beneficiary updates, and

- Communicate settlement procedures to users.

To stay compliant, fintechs should:

- Add nominee update prompts in their app onboarding flow.

- Clearly display the nominee details or “no nominee added” warnings in customer dashboards.

- Integrate digital claim submission modules for heirs.

- Sync with partner banks’ updated claim APIs post-January 2026.

These steps will not only ensure compliance but also build user trust – a key differentiator in fintech.

3. Legal and Compliance Implications

Legal teams should note:

- Documentation templates (Annex I-C and I-D) will need to be integrated into standard processes.

- Banks cannot demand extra documents beyond those listed in the RBI circular for claims within ₹15 lakh.

- Internal audit and compliance checks must verify adherence post-implementation.

4. Risk and Fraud Management

While simplifying access, banks must still guard against fraud or impersonation.

They can leverage:

- Video verification tools for claimants,

- AI-based document validation, and

- Cross-referencing of legal heir certificates via government databases.

RBI’s “based on risk management systems” clause gives banks flexibility – to design controls that ensure both speed and security.

How It Works

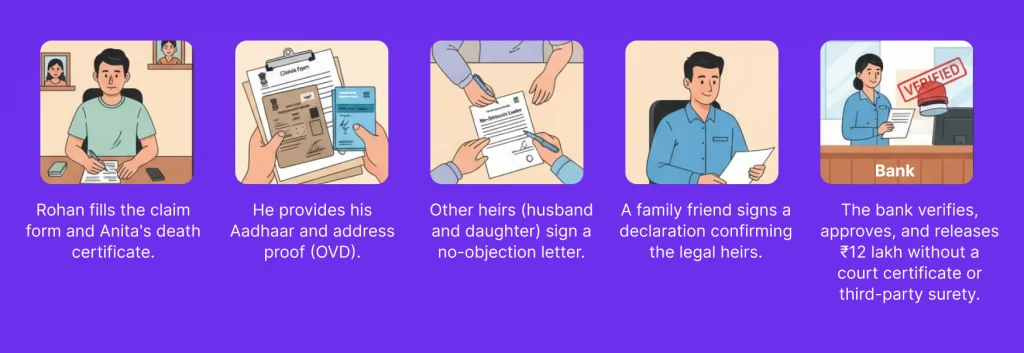

Let’s say Anita Sharma had a savings account with ₹12 lakh but passed away without naming a nominee. Her son, Rohan, approaches the bank.

Here’s how it’ll go under the new process:

- Rohan fills the claim form and attaches Anita’s death certificate.

- He provides his Aadhaar and address proof (OVD).

- Other heirs (Anita’s husband and daughter) sign a no-objection letter.

- A family friend signs a declaration confirming the family’s legal heir status.

- The bank verifies documents, approves the claim, and releases ₹12 lakh – all without needing a court certificate or third-party surety.

This saves the family weeks, if not months, of delay.

Conclusion

The RBI’s draft circular marks a progressive and humane step towards simplifying claim settlements for ordinary citizens. By standardising procedures and reducing friction, it aligns the banking system with real-world family scenarios – where legal heirs should not have to fight to access rightful funds.

While the ₹15 lakh threshold may seem modest, it covers a vast majority of savings and deposit accounts in India. Once finalised, this framework will bring consistency, transparency, and compassion to an area long burdened by red tape.

Fintechs and banks alike should prepare early by updating processes, digitising claim workflows, and embedding nominee management seamlessly into customer journeys.