RBI Rules for Banks have changed for co-operative banks. Under the new ECBA framework, eligible co-op banks can open more branches, install ATMs/CDMs, and start doorstep banking faster—often without prior RBI approval.

In other words, the RBI ECBA framework is not “relaxation without control.” Rather, it’s a faster operating model for banks that meet eligibility norms.

This guide breaks down what changed, why it matters, and what co-op banks (and fintechs building for them) should do next.

What Changed Under the RBI ECBA Framework?

For years, RBI used the FSWM (Financially Sound and Well Managed) approach to decide which co-operative banks could:

- open branches,

- install ATMs,

- expand into new regions,

- or launch new service channels.

However, FSWM often felt slow and binary. As a result, even capable banks faced delays when they wanted to modernise.

Now, the RBI has introduced the RBI ECBA framework (Eligibility Criteria for Business Authorisation) to replace that model. So, when a bank meets ECBA norms, it can expand faster—without seeking permission for each change.

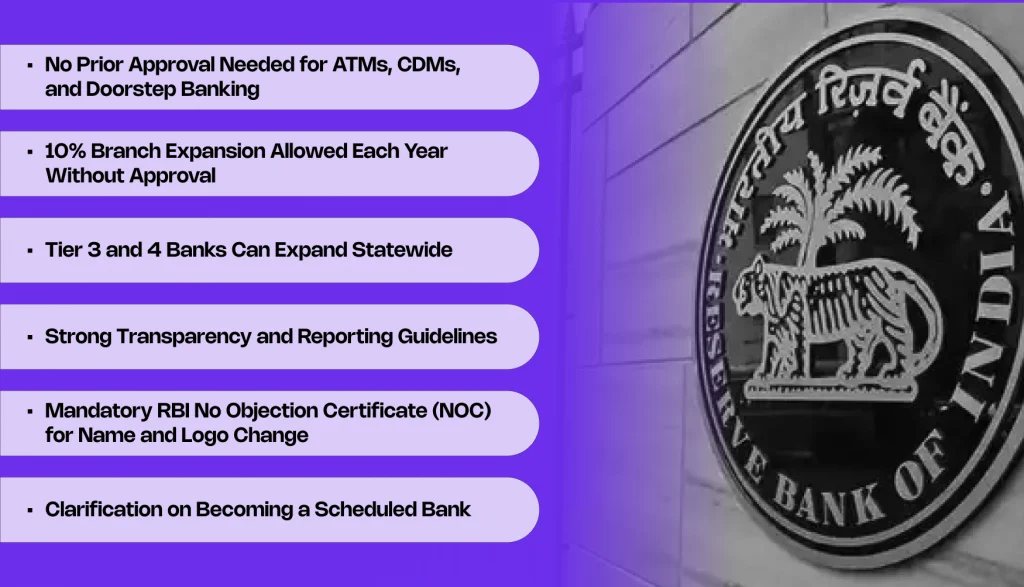

Key Highlights of the RBI ECBA Framework

1) RBI ECBA framework: No prior approval for ATMs, CDMs, and doorstep banking

Under the RBI ECBA framework, eligible co-operative banks can install:

- ATMs

- CDMs

- and start doorstep banking

without prior RBI approval.

Therefore, banks can improve access faster, especially in rural and semi-urban regions where customers still face limited banking infrastructure.

2) RBI ECBA framework: 10% branch expansion per year without approval

The RBI ECBA framework allows eligible banks to open up to 10% new branches annually (based on existing branch count) without individual approvals.

Meanwhile, banks that don’t meet ECBA norms still need RBI permission. So, eligibility becomes the growth fast lane.

Why this matters: Branch expansion becomes predictable. As a result, co-op banks can plan growth better and serve customers sooner.

3) RBI ECBA framework: Tier 3 and Tier 4 banks can expand statewide

RBI also permits Tier 3 and Tier 4 co-operative banks to expand anywhere within their state, instead of staying limited to narrower operating areas.

As a result, banks can reach underserved districts faster. Additionally, statewide expansion helps co-op banks compete more effectively with larger banks and digital-first players.

4) RBI ECBA framework: Stronger reporting and transparency requirements

Even though the RBI reduces approvals under the RBI ECBA framework, it strengthens monitoring through reporting. For example:

- Banks must inform the RBI about branch openings, closures, or relocations within 7 days

- Banks must submit monthly NIL reports even if there are no changes

Therefore, the model becomes: expand faster, but stay traceable.

5) RBI ECBA framework: Mandatory RBI NOC for name and logo changes

Under the RBI ECBA framework, any co-operative bank that wants to change its name or logo must first obtain an RBI No Objection Certificate (NOC).

This matters because branding confusion can mislead customers. So, RBI wants banks to protect trust and prevent lookalike identity risks.

6) RBI ECBA framework: A clearer process to become a Scheduled Bank

For the first time, the RBI has clarified the process for a co-operative bank to become a Scheduled Bank.

In practice, this clarity helps banks work toward stronger regulatory standing and higher credibility. Therefore, banks that want to “level up” can follow a more structured path.

What These Changes Mean for Co-operative Banks

Overall, the RBI ECBA framework signals a shift toward responsible autonomy.

- If banks meet eligibility norms, the RBI lets them expand faster.

- However, RBI also expects clean reporting, stronger governance, and operational discipline.

- As a result, banks that invest in compliance maturity will benefit the most.

In short, the RBI ECBA framework rewards readiness.

Benefits for Customers

Because the RBI ECBA framework speeds up service expansion, customers should see real improvements:

- More branches in rural and semi-urban areas

- More ATMs and CDMs, which reduce dependence on branch visits

- Doorstep banking is especially useful for elderly or remote customers

- Faster upgrades, because banks can act without waiting for approvals

Therefore, the customer experience becomes more accessible and more consistent.

Where BeFiSc Fits in the RBI ECBA framework Ecosystem

When the RBI gives co-op banks more freedom under the RBI ECBA framework, execution quality becomes the real differentiator.

That’s where BeFiSc fits naturally.

As co-op banks expand branches, roll out ATMs/CDMs, and scale doorstep banking, they also need:

- stronger identity verification

- cleaner fraud signal checks

- audit-friendly compliance workflows

—without slowing growth.

BeFiSc helps teams operationalise trust through APIs that support:

- identity verification and screening at onboarding.

- Risk and fraud signal checks before decisions.

- audit-ready workflows designed for scaling operations.

Book a demo to see how BeFiSc supports co-op bank verification and risk workflows.

Conclusion: The RBI ECBA framework creates a Real Growth Window

RBI’s message is clear: move faster, but stay eligible and transparent. The RBI ECBA framework gives co-operative banks a genuine window to modernise without approval bottlenecks.

So, for co-op banks, this is the right moment to:

- catch up on tech,

- expand reach, and

- improve customer service—responsibly.

Meanwhile, fintechs building for co-op banks can now co-create scalable infrastructure: compliance automation, monitoring systems, identity checks, fraud controls, and modern service delivery.

Follow BeFiSc for more RBI circulars decoded into clear, actionable steps.

FAQs

What is the RBI ECBA framework?

The RBI ECBA framework defines eligibility criteria for business authorisation. If a co-op bank meets ECBA norms, it can expand services faster while the RBI maintains oversight through reporting.

Under the RBI ECBA framework, do co-op banks need approval for ATMs and doorstep banking?

Eligible banks generally don’t need prior approval for ATMs, CDMs, or doorstep banking. Instead, they can act faster and then comply with RBI reporting requirements.

What are the co-operative bank branch expansion rules under the RBI ECBA framework?

Under the RBI ECBA framework, eligible banks can open up to 10% new branches per year without individual approvals. Meanwhile, non-eligible banks still need RBI permission.

What is the difference between FSWM and ECBA?

FSWM often worked like a slower classification gate. In contrast, ECBA focuses on eligibility criteria and links operational freedom to compliance readiness, so well-managed banks get more autonomy.