For decades, Indian households have treated silver as a safe store of value. It sits quietly in lockers, cupboards, and family vaults.

However, until now, that silver rarely helped people access formal credit.

That is about to change.

Loan against silver is now set to become a regulated borrowing option in India. From April 1, 2026, the Reserve Bank of India (RBI) will allow banks and NBFCs to offer loans by accepting silver ornaments and coins as collateral, bringing silver-backed lending under formal RBI rules.

So, if you have ever searched for “loan against silver near me” or wondered whether banks offer silver loans, the answer is now yes — under RBI oversight.

What Is a Loan Against Silver?

A loan against silver is a secured loan where a borrower pledges silver ornaments or silver coins to a regulated lender in exchange for funds.

Under the new silver loan RBI framework, lenders can issue a silver collateral loan with defined rules around:

- Valuation

- Loan-to-value (LTV) limits

- Collateral storage

- Borrower rights

In other words, silver loans will now function much like gold loans — but with clearer compliance guardrails.

Why RBI Introduced Silver Collateral Loans

Until now, gold dominated the secured lending space. Meanwhile, silver-backed borrowing largely remained informal.

As a result, borrowers often faced unclear valuation, higher risk, and weak protections.

Therefore, RBI stepped in.

The RBI silver loan guidelines aim to:

- Expand access to formal credit

- Reduce dependence on informal lenders

- Standardise silver valuation

- Improve transparency and borrower safety

Most importantly, RBI wants silver-backed credit to become regulated, auditable, and fair.

When Will Loan Against Silver Start?

📅 Effective from April 1, 2026

Between now and then, banks and NBFCs must:

- Set up valuation and assaying processes

- Arrange secure vault storage

- Train staff on silver handling

- Upgrade audit and compliance systems

Consequently, borrowers will see more reliable and standardised silver loan offerings.

Who Can Offer a Silver Collateral Loan?

According to RBI, the following institutions can provide a loan against silver:

- Commercial banks

- Small finance banks

- Regional rural banks

- Urban and rural co-operative banks

- NBFCs

- Housing finance companies

So, when people search for loan against silver near me, most regulated lenders will soon qualify to offer it.

Who Is Eligible to Borrow?

Any individual who personally owns silver ornaments or silver coins can apply for a silver collateral loan.

However, RBI clearly prohibits lending against:

- Silver bullion or bars

- Silver-backed ETFs or financial products

- Re-pledged or disputed assets

Simply put, the borrower must prove clear ownership.

What Type of Silver Qualifies?

Allowed

- Silver ornaments

- Silver coins

Not allowed

- Raw silver or bullion

- Financial instruments linked to silver

- Assets with unclear ownership

Because of this clarity, silver loans become safer for both borrowers and lenders.

RBI-Defined Weight Limits

To prevent excessive exposure, RBI has fixed strict caps:

Importantly, these limits apply per borrower across all lenders.

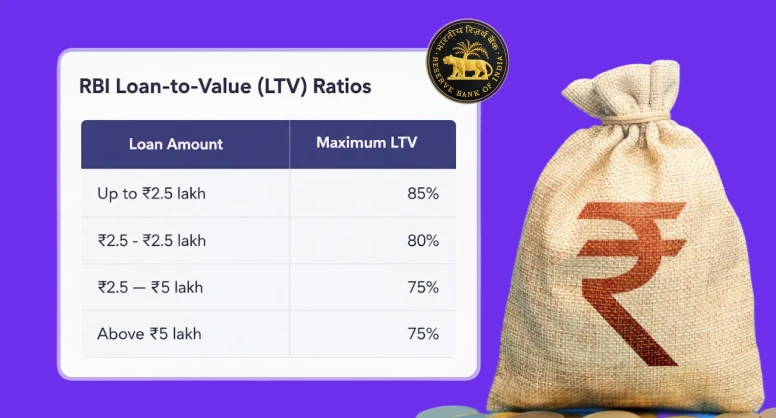

Loan-to-Value (LTV) Ratio for Silver Loans

Under the silver loan RBI rules, lenders must follow tiered LTV limits:

For example, if your silver collateral loan is valued at ₹1 lakh, you may receive up to ₹85,000 depending on the loan slab.

How Will Silver Be Valued?

To avoid manipulation, RBI has standardised valuation.

Lenders must use the lower of:

- Average closing price of the last 30 days

- Previous day’s closing price

Prices must come from:

- IBJA, or

- A SEBI-regulated commodity exchange

Additionally, lenders can only consider the intrinsic metal value. They cannot add premiums for design or craftsmanship.

Transparency and Borrower Protection

RBI has strengthened borrower rights. Therefore:

- Borrowers must remain present during valuation

- Lenders must issue a valuation certificate

- Loan agreements must clearly disclose fees, auction rules, and timelines

- Communication must happen in the borrower’s preferred language

As a result, silver collateral loans become far more transparent than informal alternatives.

What Happens After Full Repayment?

Once the borrower repays the loan:

- The lender must return the silver on the same day, or

- Within 7 working days

If the lender delays due to internal reasons, they must pay ₹5,000 per day as compensation.

Because of this clause, borrower confidence increases significantly.

What If the Borrower Defaults?

RBI allows auctions, but only under strict conditions:

- Lenders must issue prior notice

- If the borrower remains untraceable, lenders must publish a public notice

- The reserve price must be at least 90% of current value

- Only after two failed auctions can it drop to 85%

Thus, RBI ensures fairness even during recovery.

Where BeFiSc Fits In

As loan against silver products enter formal lending, documentation quality becomes critical.

BeFiSc supports lenders by:

- Detecting tampered valuation reports and loan PDFs

- Verifying collateral-related documents

- Maintaining audit-ready trails for RBI inspections

- Reducing fraud without slowing lending workflows

In secured lending, verified documents matter as much as verified collateral.

Final Takeaway

The RBI’s decision to allow a loan against silver brings silver into India’s regulated credit system.

From April 2026 onward, borrowers searching for loan against silver near me can expect safer, more transparent silver collateral loans. At the same time, lenders gain a new asset class backed by clear compliance rules.

If you are building or scaling silver collateral loan products, now is the right time to strengthen verification and compliance.

Explore how BeFiSc helps lenders stay RBI-ready without adding friction.

FAQs

1. Is loan against silver allowed in India?

Yes. RBI has allowed loans against silver under its 2025 guidelines, effective from April 1, 2026.

2. Can I get a loan against silver near me?

From April 2026, banks and NBFCs across India can offer loans against silver ornaments and coins.

3. What is the maximum LTV for a silver collateral loan?

RBI allows up to 85% LTV for loans up to ₹2.5 lakh.

4. Does RBI allow silver bullion for loans?

No. RBI permits only silver ornaments and coins, not bullion or bars.