The Reserve Bank of India (RBI) has released its updated Master Circular on the disbursement of government pensions by agency banks, consolidating all relevant instructions up to March 31, 2025. This is a crucial update for all agency banks, government pensioners, and financial administrators involved in the pension payment process.

In this blog, we break down this comprehensive circular in a simple way, so banks and pensioners alike can understand what’s changed, what’s expected, and what rights retirees hold when it comes to their hard-earned pensions.

What is the Master Circular on Pension Disbursement?

The Master Circular titled “Disbursement of Government Pension by Agency Banks” serves as a rulebook for how banks appointed by the government (called “agency banks”) should manage and execute pension payments. This includes:

- Monthly pension disbursement

- Dearness Relief (DR) updates

- Grievance redressal

- Timely credits and refunds

- Facilities for sick and incapacitated pensioners

This circular ensures that the instructions from the government (both Central and State) are followed efficiently and consistently by the banks handling pensions.

RBI’s Key Instruction Highlights for 2024–25

1. No Delay in Dearness Relief Payments

Previously, agency banks would wait to receive physical orders from the government before processing DR changes. To reduce delay and serve pensioners faster, RBI now instructs banks to:

- Accept email, fax, post, or download DR orders from government websites

- Act immediately without waiting for further approval from RBI

- Authorize pension-paying branches to process DR as soon as government notifies it

This ensures timely credit of increased pension and DR amounts to senior citizens.

2. Immediate Implementation of Government Orders

The RBI has made it clear: agency banks must implement all government circulars (central and state) related to pensions without delay. Banks are not to wait for RBI’s separate confirmation on these matters.

This provision puts accountability directly on the banks, ensuring faster services for pensioners.

3. Timely Pension Disbursement

The RBI circular reiterates that the timing of pension credit will be guided by the instructions of Pension Paying Authorities. The bank must ensure the credit of monthly pension on time, without unnecessary delays.

4. Refund of Excess Pension: Who Is Responsible?

Sometimes, pensioners may receive excess payments due to clerical or system errors. The RBI categorizes this into two scenarios:

- If it’s the bank’s error, the entire excess amount must be refunded to the government immediately, regardless of whether recovery from the pensioner is complete.

- If it’s due to a government error, banks must contact the concerned government department directly, with a time-bound resolution, without involving RBI.

Special Care for Sick and Incapacitated Pensioners

The RBI has laid down human-centric guidelines for old, sick, and incapacitated pensioners who are unable to visit the branch or sign cheques:

- If the pensioner can provide a thumb/toe impression, it must be verified by two witnesses, one being a bank official.

- If even that’s not possible, a mark on the cheque/withdrawal slip will suffice, again verified by two witnesses including a bank official.

- The bank should allow a nominated person to withdraw the pension on their behalf, identified with signatures and witness.

Branches must display these instructions prominently and sensitise staff to ensure ease of withdrawal for elderly customers.

Joint Account Rules for Family Pensioners

If a pensioner passes away, the spouse who is the nominee should be allowed to continue using the same joint account to receive family pension-no need to open a new account if the PPO allows it.

This simplifies processes for grieving families and reduces paperwork.

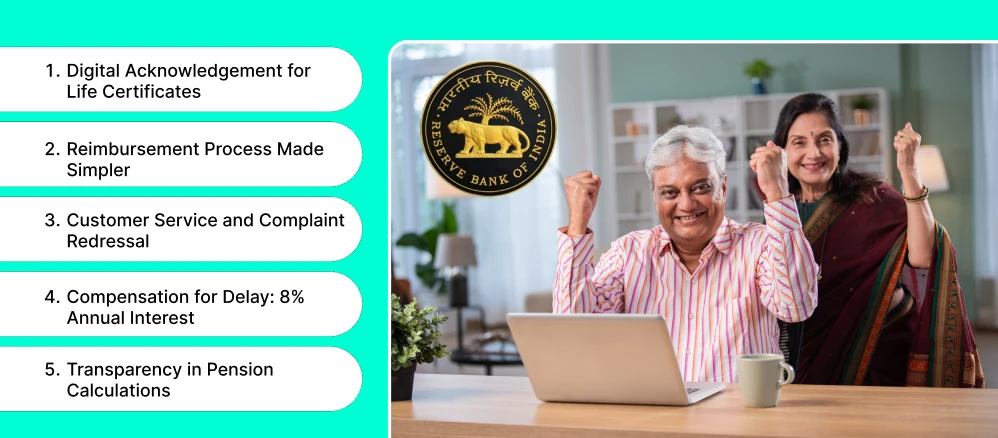

Digital Acknowledgement for Life Certificates

To avoid delays due to misplaced life certificates, RBI has directed banks to:

- Provide signed acknowledgements for physical life certificates submitted at branches

- Update entries in Core Banking System (CBS)

- Enable digital acknowledgements for online submissions through Jeevan Pramaan

This will help pensioners know their certificate was received and avoid pension stoppage.

Reimbursement Process Made Simpler

Banks’ link branches must now submit their reimbursement claims to:

- RBI’s Central Accounts Section, Nagpur (for Central Government pensions)

- Regional Offices (for State Government pensions)

Additionally, a Single Window System is being adopted to eliminate delays in reimbursements.

Customer Service and Complaint Redressal

One of the major focus areas of this circular is improving customer service for pensioners.

RBI recommends:

- Setting up dedicated toll-free lines with trained staff to handle pension queries

- Appointing nodal officers at each regional level to regularly monitor complaints

- Conducting quarterly meetings with pensioners to understand grievances

- Setting up Pension Adalat-style forums to settle complaints in a transparent way

The GM or CGM of each bank region must personally review complaints every month.

Compensation for Delay: 8% Annual Interest

This is one of the most powerful provisions of the circular.

If a pension is credited late, the agency bank must:

- Pay 8% annual interest on the delayed amount

- Credit the interest automatically without any request from the pensioner

- Maintain records of such payments for RBI inspections

This move enforces financial accountability on banks and ensures pensioners are not left helpless during delays.

Transparency in Pension Calculations

To ensure pensioners are aware of how their pension is calculated, RBI has asked banks to:

- Make pension calculation details available online and at branches

- Help pensioners understand how revisions and DR hikes affect their amount

- Clearly guide them in case of confusion

Every pensioner deserves to know how their monthly income is computed.

Internal Audits and Inspections

Agency banks must now include pension-related service quality as a formal part of their internal audits. RBI has mandated:

- Audit checklists to include pension timeliness, DR revision, life certificates, etc.

- Random calls to pensioners by inspectors to get direct feedback

- Grievance tracking and status updates as part of internal inspection reports

The idea is to ensure ongoing accountability in pension service delivery.

Annex: Key Checklist Points for Banks

RBI has provided a specific checklist banks must follow:

- Timely credit of pensions (before month-end, except March)

- Handling of revised DR/pension updates without delay

- Proper acknowledgment of life certificates

- TDS deduction wherever applicable

- Nominations and joint accounts updated

- Grievance resolution system in place

- Full audit trail and record keeping of all pension-related transactions

These measures will standardise service levels and protect pensioner interests across India.

What This Means for Pensioners

For retired government employees, especially those dependent on monthly pensions, the RBI circular brings a much-needed sense of security and accountability. It ensures:

- No unnecessary delays

- Interest on late payments

- Ease of access for the elderly or incapacitated

- More transparent communication

- Real-time updates through digital acknowledgements

For Banks: Strict Compliance Required

Agency banks have been clearly told-delays won’t be tolerated. All actions will now be audited, and complaints will be tracked with nodal officer accountability.

This is a positive step in ensuring India’s pensioners are treated with dignity and given the support they deserve.

The bottomline

The RBI’s Master Circular for Government Pension Disbursement is not just a rulebook – it’s a blueprint for making pension disbursement more humane, efficient, and transparent.

With increasing digitisation, centralisation, and emphasis on service, these steps will go a long way in protecting the financial rights of India’s retired workforce.

Agency banks must align systems quickly, especially for audit trails, digital acknowledgements, and grievance handling, to avoid penalties and ensure senior citizen dignity.