Foreign portfolio investors in corporate debt now have greater flexibility after the RBI removed key investment limits in its 2025 update.

In its 2025 update, the Reserve Bank of India removed two long-standing restrictions that had limited how foreign investors could participate in corporate bond issuances. As a result, FPI Investment India is now more flexible, easier to structure, and better aligned with real fundraising needs.

If your business raises debt, this change can directly improve how fast—and how cleanly—you access capital.

Context: How FPI Investment India Has Evolved

Over the past few years, FPI Investment India has grown steadily, especially during phases like 2021 and 2022. Global investors continued to show interest in Indian credit markets. However, corporate bond rules often added friction that slowed down actual deal execution.

In particular, two limits affected foreign participation:

- A short-term investment cap

- An issue-wise concentration cap

Although these safeguards aimed to protect market stability, they also increased compliance overhead and reduced flexibility for issuers. Consequently, many fintechs and NBFCs had to design debt structures around regulatory limits instead of business cycles.

What Changed in FPI Investment India (2025 Update)

The RBI has now removed two major constraints that previously shaped FPI investment in India in corporate bonds.

1) FPI Investment India: Short-Term Bond Limit Removed

Earlier, foreign portfolio investors could invest only up to 30% of their corporate bond portfolio in instruments with a residual maturity of less than one year.

Now, this cap is removed.

As a result, FPI investment in India allows greater allocation to short-term corporate bonds without constant rebalancing.

2) FPI Investment India: Issue-wise Concentration Limit Removed

Previously, a single investor (or related group) could not hold more than 50% of a corporate bond issue.

This restriction has also been removed.

Accordingly, FPI Investment India now allows a single foreign investor to anchor—or even fully subscribe to—an issuance.

Together, these changes reduce operational friction and simplify debt fundraising.

Why FPI Investment India Matters for Fintechs and NBFCs

Because fintech and alternative lending models depend heavily on debt capital, changes in FPI investment in India have a direct impact on growth and liquidity planning.

Easier Short-Term and Bridge Capital

Earlier, raising short-term debt required careful structuring to stay within the 30% cap. Now, fintechs can issue 3-month or 6-month instruments without hitting allocation limits under FPI investment in India.

Example:

A lending fintech preparing for festive-season demand can raise short-term liquidity from a foreign investor and repay quickly—without compliance friction.

Faster Closures Through Anchor Participation

Earlier, the 50% limit often blocked large anchor tickets. As a result, issuers had to split issuances across multiple investors.

With the cap removed, FPI Investment India enables stronger anchor participation. This, in turn, improves confidence, speeds up closures, and supports better pricing.

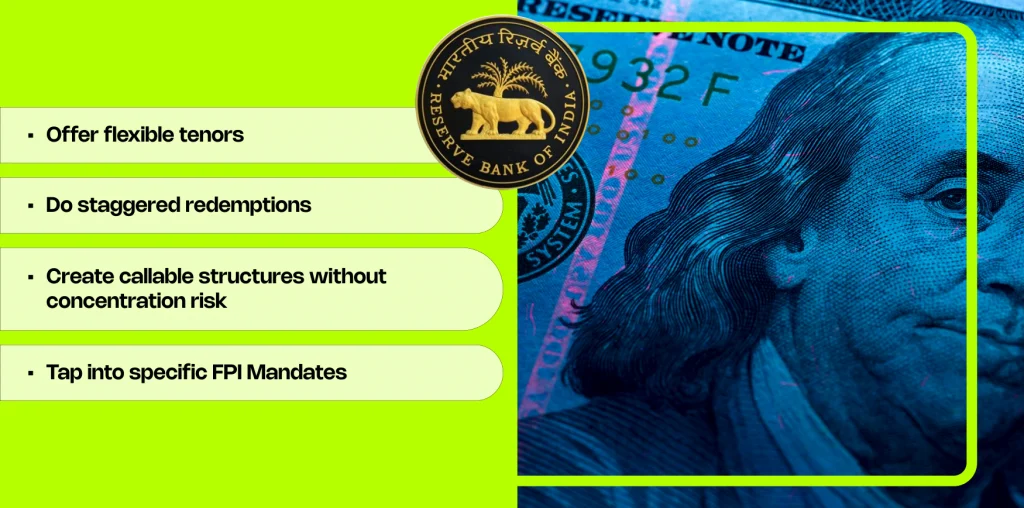

More Flexible Debt Structures Under FPI Investment India

With fewer regulatory constraints, issuers can now structure debt more realistically. For example, FPI Investment India allows fintechs to:

- Offer flexible tenors

- Use staggered redemptions

- Introduce callable structures

- Align issuances with specific investor mandates

This flexibility improves capital planning and execution.

How FPI Investment India Works Now

These relaxations apply under the General Route for FPI Investment in India.

However, some elements remain unchanged. Investors must still meet registration requirements, follow sectoral caps, and comply with custodian-level reporting. Meanwhile, other routes such as VRR and FAR continue under existing norms.

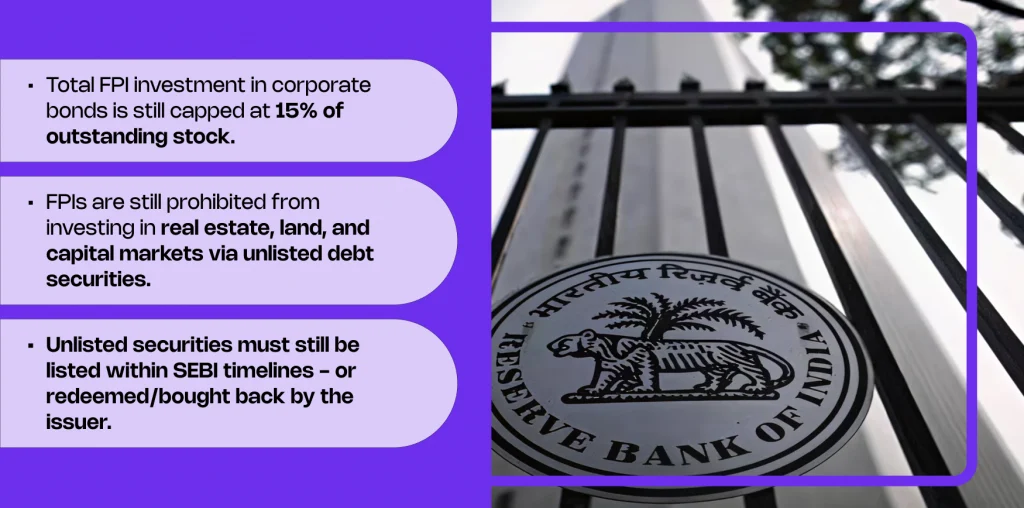

What Still Applies to FPI Investment India

Despite the easing, fpi investment in India continues to operate within strong safeguards:

- Total foreign investment in corporate bonds remains capped at 15% of outstanding stock

- Restrictions on certain exposures through unlisted debt continue

- Unlisted bonds must still be listed within prescribed timelines or redeemed.

Therefore, while access is easier, prudential discipline remains essential.

Action Points for Fintechs Using FPI Investment India

Legal & Compliance Teams should update disclosures and offering documents.

Treasury Teams should reassess capital stacks and re-engage foreign anchors.

Product Teams should design short-term and staggered structures with confidence.

Where BeFiSc Fits In

As fpi investment in India becomes more flexible, expectations around risk visibility increase.

BeFiSc helps fintechs and NBFCs:

- Maintain clear exposure and concentration visibility

- Strengthen disclosure and compliance readiness

- Scale fundraising without introducing blind spots

Simply put, BeFiSc enables safer, faster capital access.

Strategic Impact of FPI Investment in India Reforms

First, these changes align India more closely with global debt practices.

Second, they improve liquidity and price discovery.

Finally, they allow global funds to recycle capital faster, deepening long-term participation in fpi investment in India.

Conclusion

The RBI’s move marks a structural improvement in fpi investment in India, particularly for corporate debt issuers.

For fintechs and NBFCs, the upside is clear: easier short-term fundraising, stronger anchor participation, and more practical debt structures. However, disciplined risk management remains critical.

If you are planning a debt issuance, now is the right time to restructure strategically—not reactively.

FAQs

What changed in fpi investment in India for corporate bonds?

The RBI removed the 30% short-term maturity cap and the 50% issue-wise concentration cap.

Can one foreign investor fully subscribe to a bond issue?

Yes. Under the revised rules, a single investor can anchor or fully subscribe.

Is fpi investment in India now unlimited?

No. Overall limits on corporate bond exposure still apply.

Do unlisted debt rules change under FPI Investment India?

No. Listing timelines and sector-specific restrictions remain unchanged.