Two-Factor Authentication is now at the centre of how digital payments in India are being secured. As online transactions continue to rise, the Reserve Bank of India has issued a new RBI circular that strengthens authentication requirements to reduce fraud and misuse. These RBI guidelines and RBI rules mark a clear shift toward safer, risk-aware digital payments across the ecosystem.

Recognising this reality, the Reserve Bank of India has issued a new RBI circular that fundamentally changes how digital payments will be authenticated in the coming years. These updated RBI guidelines and RBI rules are designed to strengthen trust at the moment it matters most — when money moves.

This is not just another RBI notification.

It is a structural shift in how India thinks about payment security.

A Question Every Payment System Must Answer

What if most payment fraud doesn’t happen because systems fail —

but because systems trust too easily?

The latest RBI circular challenges that assumption. It introduces stronger authentication, dynamic verification, and risk-based checks that ensure every transaction earns trust instead of assuming it.

For fintechs, banks, and payment platforms, this RBI notification sends a clear message:

security must evolve with behaviour, not lag behind it.

Key Highlights:

The latest RBI circular introduces a comprehensive authentication framework aimed at reducing fraud while preserving user experience. Through clearly defined RBI guidelines and enforceable RBI rules, the central bank is setting a new baseline for digital payment security.

Below are the five most important highlights from the RBI circular.

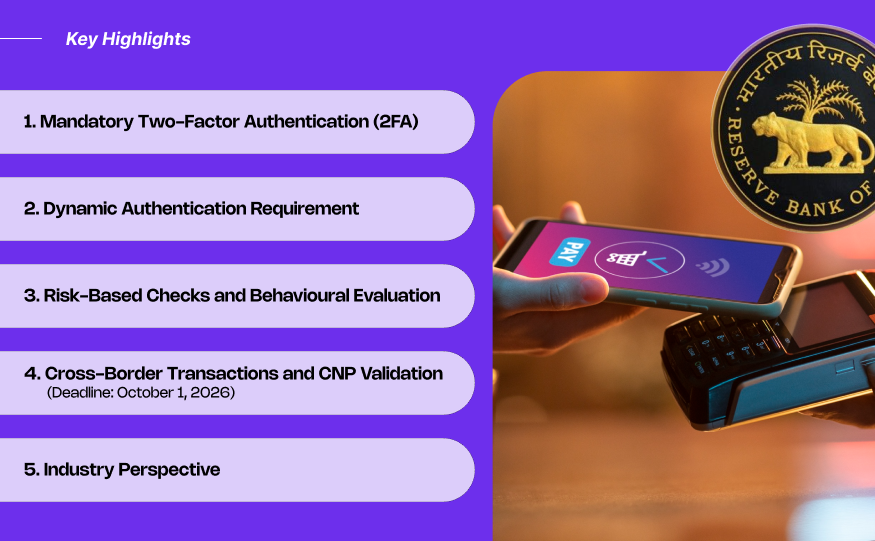

1. Mandatory Two-Factor Authentication (2FA)

Under the revised RBI guidelines, all digital payment transactions must be authenticated using at least two independent factors.

These may include:

- Something the user knows (PIN or password)

- Something the user has (device, card, token)

- Something the user is (biometric verification)

The updated RBI rules ensure that even if one factor is compromised, the transaction cannot proceed unchecked. This requirement forms the foundation of the latest RBI circular and applies across digital payment modes unless explicitly exempted.

2. Dynamic Authentication Requirement

A critical upgrade introduced through this RBI circular is the requirement for dynamic authentication.

This means:

- Authentication must be transaction-specific

- Verification must be time-bound

- Credentials cannot be reused

Static passwords alone no longer meet compliance standards under the new RBI rules. This RBI notification directly targets common fraud techniques such as phishing, replay attacks, and credential reuse.

3. Risk-Based Checks and Behavioural Evaluation

The RBI guidelines also introduce a shift from uniform authentication to risk-based verification.

Issuers may now evaluate transactions using parameters such as:

- User spending behaviour

- Device characteristics

- Transaction location

- Historical transaction patterns

If a transaction deviates from normal behaviour, additional verification can be triggered. This approach, outlined in the latest RBI circular, ensures that security intensity matches transaction risk.

4. Cross-Border Transactions and CNP Validation

The RBI notification places special focus on cross-border card-not-present (CNP) transactions, which are historically more vulnerable to fraud.

As per the updated RBI rules, card issuers must:

- Implement risk-based mechanisms for overseas CNP transactions

- Validate non-recurring international payment requests

- Register Bank Identification Numbers (BINs) with card networks

These requirements in the RBI circular aim to reduce international payment fraud and align India’s standards with global best practices.

5. Industry Perspective

Industry leaders have largely welcomed the latest RBI circular, viewing it as a necessary evolution rather than additional friction. The consensus is that these RBI guidelines formalise a smarter, more resilient authentication framework that strengthens trust across the payments ecosystem.

Impact on Fintechs and Payment Ecosystem

The RBI circular will have far-reaching implications for fintechs, banks, card issuers, and payment aggregators. This RBI notification is not theoretical — it demands real operational and technological change.

1. Product and Technology Overhaul

To comply with the RBI guidelines, fintechs must redesign payment flows to support two-factor and dynamic authentication.

This includes:

- Updating authentication APIs and SDKs

- Introducing multi-modal verification methods

- Embedding security into core product design

The latest RBI circular makes it clear that security can no longer be an afterthought.

2. Strengthening Fraud Prevention

Dynamic and risk-based authentication under the RBI rules significantly reduces exposure to:

- OTP interception

- Credential misuse

- Unauthorised recurring transactions

This RBI notification pushes fintechs to align fraud monitoring systems with behavioural and contextual risk signals.

3. Compliance and Timeline Management

The RBI circular defines clear compliance milestones:

- April 1, 2026: Mandatory two-factor and dynamic authentication

- October 1, 2026: Cross-border CNP validation and BIN registration

Meeting these RBI rules requires early coordination across product, engineering, and compliance teams.

4. Consumer Experience and Trust

While additional checks may feel like friction initially, the intent of the RBI notification is to enhance user confidence. Every compliant transaction reassures users that verification is contextual, intelligent, and protective.

Where BeFiSc Fits in This RBI Framework

This RBI circular makes one thing clear: authentication alone is no longer enough. Context and judgement now matter.

While the RBI guidelines define what must be implemented, fintechs still need systems that help decide when trust should be questioned. This is where BeFiSc fits naturally.

BeFiSc helps fintechs strengthen the risk-based layer envisioned in the RBI rules by enabling:

- Detection of document manipulation that can influence payment or onboarding decisions

- Risk signals that highlight inconsistencies before transactions are approved

- Intelligence that complements dynamic authentication without adding user friction

As authentication becomes adaptive under the latest RBI circular, BeFiSc supports smarter, trust-led decision-making.

The goal isn’t more checks.

It’s better judgment at the right moment.

A Thought to Leave With

Fraud rarely looks suspicious at first glance.

That’s why signals matter more than steps.

As RBI rules push reminder toward intelligent authentication, fintechs that invest early in risk visibility will move faster — and safer — than the rest.

FAQ

The latest RBI circular introduces mandatory two-factor authentication, dynamic verification, and risk-based checks to strengthen digital payment security in India.

The RBI guidelines come into effect from April 1, 2026, with cross-border CNP requirements applicable from October 1, 2026.

The RBI rules mandate transaction-specific dynamic authentication instead of relying only on static credentials like passwords or PINs.

The RBI notification aims to reduce fraud, protect consumers, and align India’s digital payment security standards with global best practices.