UPI already changed how India pays.

Now, it’s changing how payments get approved.

UPI fingerprint payment is set to change how Indians approve digital transactions. Under the new UPI rules 2025, users will soon be able to authenticate UPI payments using biometrics like fingerprints or facial recognition instead of entering a PIN. This shift moves UPI closer to identity-based payments that are faster, simpler, and more secure.

Let’s understand what’s changing, how it works, and why it matters.

What Are the New UPI Rules 2025?

The UPI new rules 2025 come from updated digital payment guidelines issued by the Reserve Bank of India. These guidelines allow alternative authentication methods beyond traditional PINs.

Earlier, every UPI transaction required users to enter a numeric PIN. Now, RBI permits Aadhaar-based biometric authentication, including fingerprints and facial recognition.

Because of this change:

- Payments become easier to approve

- Accessibility improves for more users

- Authentication becomes harder to misuse

Naturally, this update has dominated UPI latest news, since it reshapes how UPI handles security.

What Is UPI Fingerprint Payment and How Does It Work?

UPI fingerprint payment allows users to approve transactions using their fingerprint instead of entering a PIN.

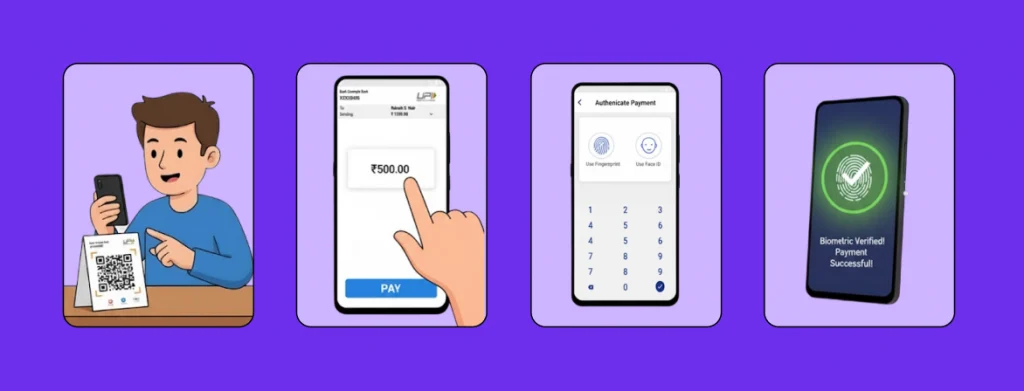

Here’s how the process works step by step:

- You start a UPI transaction by scanning a QR or approving a request.

- At the authentication stage, you select biometric verification.

- The system verifies your fingerprint or face using Aadhaar.

- Once verification succeeds, the payment goes through instantly.

As a result, users no longer need to remember or type a PIN.

The National Payments Corporation of India manages this rollout across the UPI network, ensuring that banks and apps follow a common standard. Therefore, UPI fingerprint payment works as an ecosystem-level feature, not a one-off app experiment.

Aadhaar-Based UPI Authentication and Banks

Biometric authentication depends on Aadhaar verification. That’s why searches like aadhaar upi bank of india have increased sharply.

Here’s what actually happens behind the scenes:

- Banks handle Aadhaar authentication as regulated intermediaries

- UPI apps do not store biometric data

- The system only returns a simple yes or no response

Because public sector banks often lead early rollouts, institutions such as the Bank of India are expected to play a key role. Consequently, aadhaar upi bank of india has become a frequent topic in UPI latest news.

Will You Need a New UPI App for Biometric Payments?

Despite the buzz around a new UPI app, users won’t need to download anything new.

Instead:

- Existing UPI apps will receive updates

- Biometric authentication will appear alongside PIN options

- Device support and bank readiness will determine availability

So, while people search for a new UPI app, the reality is simpler. This is a backend upgrade that improves how apps work — not a replacement for them.

Why UPI Fingerprint Payments Are a Big Shift

This update changes more than convenience. It changes how trust works in payments.

UPI fingerprint payment introduces clear advantages:

- Convenience: Users approve payments without recalling PINs

- Accessibility: Elderly and first-time users face fewer barriers

- Security: Fingerprints are harder to misuse than shared PINs

- Speed: Authentication happens faster in real-world settings

Therefore, among all updates under the UPI new rules 2025, this one stands out the most — and explains why it dominates UPI latest news coverage.

What the Latest UPI News Signals for the Future

If you track UPI latest news, a few patterns appear consistently:

- Biometric payments will roll out in phases

- PIN-based authentication will remain available

- Explicit user consent will stay mandatory

- Compliance standards will remain strict

As a result, UPI continues to evolve without sacrificing trust. Payments become smoother, while safeguards stay firmly in place.

What This Means for Trust, Security, and Fraud Prevention

Biometrics strengthen authentication. However, no single signal can guarantee trust on its own.

UPI fingerprint payment confirms identity effectively. Still, strong fraud prevention depends on layering multiple signals together — identity, behaviour, transaction patterns, and risk indicators.

At BeFiSc, this reinforces a core belief:

identity proves who someone is, but trust comes from context.

As systems adapt to the UPI new rules 2025, trust-first design becomes non-negotiable.

Final Thoughts

The UPI new rules 2025 mark a clear turning point.

Payments are moving:

- From PINs to fingerprints

- From memory to identity

- From friction to flow

With UPI fingerprint payment, UPI isn’t just getting faster. It’s getting smarter.

Digital payments keep evolving — and so do fraud risks.

Understanding how authentication, identity, and trust signals work together matters more than ever.

Follow BeFiSc for clear, practical insights on digital trust, payment security, and fraud prevention — without the jargon.

FAQs

Is UPI fingerprint payment safe?

Yes. Aadhaar-based verification only confirms identity. UPI apps and banks do not store biometric data.

Will UPI PIN still be required?

Yes. PIN-based authentication will continue as a fallback option.

Is Aadhaar mandatory for biometric UPI payments?

Yes. Users must link Aadhaar to enable fingerprint or facial authentication.

Do users need a new UPI app?

No. Existing apps will support biometric authentication through updates. A separate new UPI app is not required.