The RBI has overhauled its regulatory approach for co-operative banks by introducing the new Eligibility Criteria for Business Authorisation (ECBA) framework. This replaces the older FSWM (Financially Sound and Well Managed) model. Key updates include freedom to install ATMs, CDMs, start doorstep banking, and open up to 10% more branches per year – without RBI approval, if banks meet ECBA norms. The changes empower Tier 3 and 4 co-operative banks to expand within their state and promote deeper financial access.

Context

For years, co-operative banks operated under strict controls due to their risk profile, governance gaps, and weak financial reporting. The earlier FSWM (Financially Sound and Well Managed) classification was used to determine which banks could expand, set up new branches, or offer modern services like ATMs or digital payments.

But the FSWM framework had its limitations – it was binary, opaque, and often slow-moving. RBI’s newly released circular replaces it with a clearer and more data-driven framework: the Eligibility Criteria for Business Authorisation (ECBA).

This move comes at a time when co-operative banks are trying to digitise, compete with fintechs, and serve underbanked regions. By relaxing approvals but still maintaining strong oversight through reporting – the RBI is signalling trust in well-governed co-op banks.

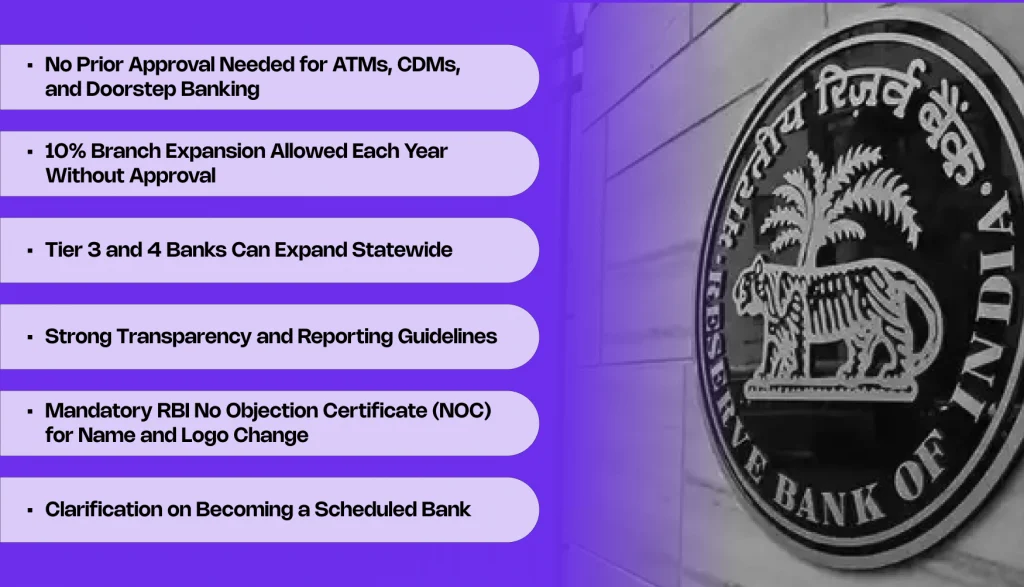

Key Highlights of the New RBI Circular

1. No Prior Approval Needed for ATMs, CDMs, and Doorstep Banking

Under the new rules, banks that qualify under the ECBA can now install Automated Teller Machines (ATMs), Cash Deposit Machines (CDMs), and start doorstep banking services without seeking RBI’s prior approval. This is a game-changing development aimed at improving customer convenience, especially for those in rural and semi-urban locations who previously had limited access to such facilities.

2. 10% Branch Expansion Allowed Each Year Without Approval

Co-operative banks that meet the ECBA eligibility norms may establish up to 10% new branches annually based on their existing branch count without obtaining individual RBI clearance. This will help banks expand their physical reach more rapidly and respond to customer needs locally. Banks that do not meet the ECBA criteria will still need prior regulatory permission for branch expansion.

3. Tier 3 and 4 Banks Can Expand Statewide

The RBI has taken a major step to boost rural banking by permitting Tier 3 and Tier 4 co-operative banks to open branches anywhere within their respective states. Previously, expansion was more restrictive and limited to specific areas. This statewide freedom will foster enhanced financial inclusion and better access to banking infrastructure across the regions these banks serve.

4. Strong Transparency and Reporting Guidelines

To maintain oversight despite these relaxations, RBI has mandated strict reporting requirements from co-operative banks:

- Banks must inform RBI about any branch openings, closures, or relocations within seven days.

- Monthly NIL reports must be submitted even if there are no changes.

These requirements are designed to ensure that the RBI remains well-informed about the operational status of all co-operative banks and can quickly intervene if necessary.

5. Mandatory RBI No Objection Certificate (NOC) for Name and Logo Change

Brand identity is critical in banking, and the RBI has introduced a rule that any co-operative bank seeking to change its name or logo must first secure a No Objection Certificate from the RBI. This prevents any misleading branding or confusion with other financial institutions and ensures transparency for customers.

6. Clarification on Becoming a Scheduled Bank

For the first time, the RBI has clearly laid out the process for a co-operative bank to become a Scheduled Bank. This clarity will help banks aspire to higher regulatory statuses, thereby enhancing their credibility and operational scope.

What These Changes Mean for Co-operative Banks

This new regime signals a transformational reform in the governance and functioning of co-operative banks. By balancing regulatory oversight with operational flexibility, the RBI empowers these banks to make faster business decisions and improve their services without compromising on financial discipline.

The introduction of the ECBA framework encourages banks to maintain strong capital adequacy, manage non-performing assets prudently, and stay profitable – all essential benchmarks for sustainable growth.

The ability to quickly expand branches and provide doorstep banking and ATM facilities will help co-operative banks strengthen their presence in underserved markets and serve a wider customer base.

Benefits for Customers

- More Bank Branches in Rural and Semi-urban Areas: With fewer hurdles in opening branches, customers can expect banks to be physically closer, making banking more accessible.

- Improved ATM and Cash Deposit Facilities: The removal of approval processes for ATMs and CDMs will lead to an increase in these convenient self-service machines in place.

- Doorstep Banking: Customers who face mobility challenges or live in remote areas will benefit immensely from doorstep banking services.

- Faster and More Responsive Services: With banks empowered to act swiftly, local banking needs will be addressed more promptly and efficiently.

Conclusion

RBI’s latest circular is a big leap toward modernising and decentralising co-operative banking. By removing the need for approvals while keeping a strong check through reporting, RBI is signalling: “We trust you, if you’re eligible and responsible.”

For co-op banks, this is a golden window to:

- Catch up on tech

- Expand reach

- Offer better customer service

For fintechs – particularly those working with or building for co-op banks – the opportunity is now to co-create scalable infrastructure: smart ATMs, doorstep delivery tools, automated compliance modules, and modern branch operations.